Essay

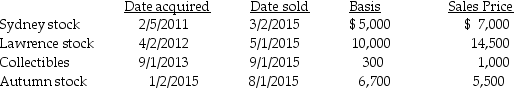

Chen had the following capital asset transactions during 2015:  What is the adjusted net capital gain or loss and the related tax due to the above transactions, assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions, assuming Chen has a 25% marginal tax rate?

Correct Answer:

Verified

Long-term  Short-ter...

Short-ter...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q12: Funds borrowed and used to pay for

Q47: Allison buys equipment and pays cash of

Q49: Gina owns 100 shares of XYZ common

Q76: Because of the locked-in effect,high capital gains

Q85: Coretta sold the following securities during 2015:

Q91: How long must a capital asset be

Q92: Tina, whose marginal tax rate is 33%,

Q94: During the current year, Nancy had the

Q130: Net long-term capital gains receive preferential tax