Essay

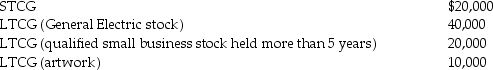

Tina, whose marginal tax rate is 33%, has the following capital gains this year:  What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q49: Gina owns 100 shares of XYZ common

Q66: Adjusted net capital gain is taxed at

Q76: Because of the locked-in effect,high capital gains

Q89: Chen had the following capital asset transactions

Q91: How long must a capital asset be

Q94: During the current year, Nancy had the

Q96: Stock purchased on December 15,2014,which becomes worthless

Q106: An uncle gifts a parcel of land

Q130: Net long-term capital gains receive preferential tax