Multiple Choice

Daniel recognizes $35,000 of Sec. 1231 gains and $25,000 of Sec. 1231 losses during the current year. The only other Sec. 1231 item was a $4,000 loss three years ago. This year, Daniel must report

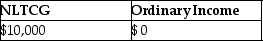

A)

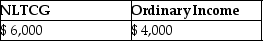

B)

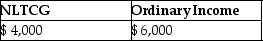

C)

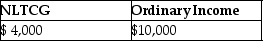

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: Connors Corporation sold a warehouse during the

Q25: If no gain is recognized in a

Q43: In 1980,Artima Corporation purchased an office building

Q52: If a taxpayer has gains on Sec.1231

Q59: Sec.1231 property must satisfy a holding period

Q63: Which of the following assets is 1231

Q73: The following gains and losses pertain to

Q75: An unincorporated business sold two warehouses during

Q105: All of the following statements are true

Q109: Hilton,a single taxpayer in the 28% marginal