Essay

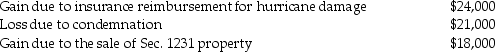

The following gains and losses pertain to Jimmy's business assets that qualify as Sec. 1231 property. Jimmy does not have any nonrecaptured net Sec. 1231 losses from previous years, and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.  Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Correct Answer:

Verified

The $24,000 casualty gain is treated as ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: In order to be considered Sec.1231 property,all

Q15: Connors Corporation sold a warehouse during the

Q63: Which of the following assets is 1231

Q65: In 2015,Thomas,who has a marginal tax rate

Q68: If the accumulated depreciation on business equipment

Q69: This year Jenna had the gains and

Q71: Clarise bought a building three years ago

Q75: An unincorporated business sold two warehouses during

Q78: Daniel recognizes $35,000 of Sec. 1231 gains

Q109: Hilton,a single taxpayer in the 28% marginal