Multiple Choice

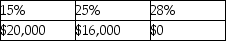

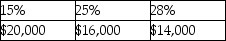

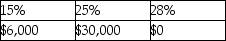

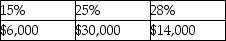

Yelenis, whose tax rate is 28%, sells one Sec. 1231 asset this year, resulting in a $50,000 gain. Included in the $50,000 Sec. 1231 gain is $30,000 of unrecaptured Sec. 1250 gain. A review of Yelenis tax files for the past five years indicates one prior Sec. 1231 sale which resulted in a $14,000 loss. The gain will be taxed as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q23: If the recognized losses resulting from involuntary

Q31: Gains and losses from involuntary conversions of

Q43: In 1980,Artima Corporation purchased an office building

Q46: A taxpayer purchased a factory building in

Q72: Sec.1245 can increase the amount of gain

Q83: Dinah owned land with a FMV of

Q85: The sale of inventory results in ordinary

Q86: Lucy, a noncorporate taxpayer, experienced the following

Q91: During the current year,George recognizes a $30,000

Q91: The following gains and losses pertain to