Essay

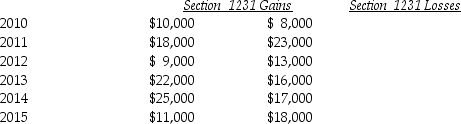

Lucy, a noncorporate taxpayer, experienced the following Section 1231 gains and losses during the years 2010 through 2015. Her first disposition of a Sec. 1231 asset occurred in 2010. Assuming Lucy had no capital gains and losses during that time period, what is the tax treatment in each of the years listed?

Correct Answer:

Verified

Correct Answer:

Verified

Q23: If the recognized losses resulting from involuntary

Q25: If no gain is recognized in a

Q31: Gains and losses from involuntary conversions of

Q43: In 1980,Artima Corporation purchased an office building

Q46: A taxpayer purchased a factory building in

Q59: Sec.1231 property must satisfy a holding period

Q72: Sec.1245 can increase the amount of gain

Q88: Yelenis, whose tax rate is 28%, sells

Q91: During the current year,George recognizes a $30,000

Q91: The following gains and losses pertain to