Multiple Choice

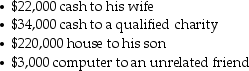

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to the unified transfer tax is

The total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to the unified transfer tax is

A) $206,000.

B) $214,000.

C) $234,000.

D) $279,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: A tax bill introduced in the House

Q4: A progressive tax rate structure is one

Q23: Leonard established a trust for the benefit

Q23: The IRS must pay interest on<br>A)all tax

Q36: A taxpayer's average tax rate is the

Q47: What are the correct monthly rates for

Q50: When returns are processed,they are scored to

Q81: If a taxpayer's total tax liability is

Q93: When new tax legislation is being considered

Q421: Explain how returns are selected for audit.