Multiple Choice

What are the correct monthly rates for calculating failure to file and failure to pay penalties?

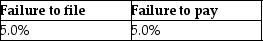

A)

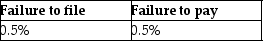

B)

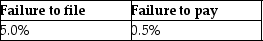

C)

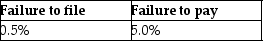

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: A tax bill introduced in the House

Q23: The IRS must pay interest on<br>A)all tax

Q35: Which of the following is not a

Q36: A taxpayer's average tax rate is the

Q43: Paul makes the following property transfers in

Q50: When returns are processed,they are scored to

Q51: Chris, a single taxpayer, had the following

Q61: The marginal tax rate is useful in

Q74: The various entities in the federal income

Q93: When new tax legislation is being considered