Essay

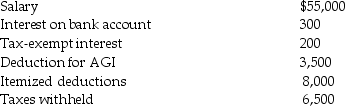

Chris, a single taxpayer, had the following income and deductions during 2015:  Calculate Chris's tax liability due or refund for 2015.

Calculate Chris's tax liability due or refund for 2015.

Correct Answer:

Verified

Tax $5,156.25 + .25(39,800 - ...

Tax $5,156.25 + .25(39,800 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q9: The term "tax law" includes<br>A)Internal Revenue Code.<br>B)Treasury

Q13: The largest source of revenues for the

Q35: Which of the following is not a

Q36: A taxpayer's average tax rate is the

Q47: What are the correct monthly rates for

Q58: Organizing a corporation as an S Corporation

Q61: The marginal tax rate is useful in

Q74: The various entities in the federal income

Q74: Peyton has adjusted gross income of $2,000,000

Q93: When new tax legislation is being considered