Essay

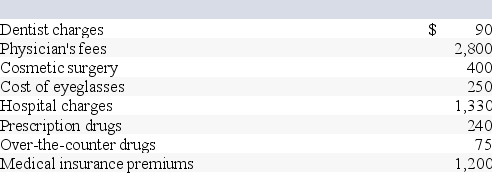

Jenna (age 50)files single and reports AGI of $40,000.This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Correct Answer:

Verified

$1,910.

All expenses are qualified medic...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

All expenses are qualified medic...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: This year Darcy made the following charitable

Q2: This year Kelly bought a new auto

Q3: Rachel is an accountant who practices as

Q4: Which of the following costs is NOT

Q5: This year, Benjamin Hassell paid $20,000 of

Q7: Frieda is 67 years old and deaf.If

Q8: Homer is an executive who is paid

Q31: Taxpayers generally deduct the lesser of their

Q47: Cesare is 16 years old and works

Q84: Unreimbursed employee business expenses and hobby expenses