Essay

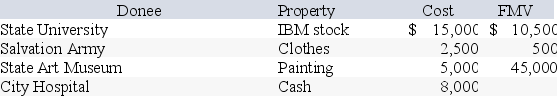

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years and the painting is used in the State Art Museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years and the painting is used in the State Art Museum's charitable purpose.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: This year Kelly bought a new auto

Q3: Rachel is an accountant who practices as

Q4: Which of the following costs is NOT

Q5: This year, Benjamin Hassell paid $20,000 of

Q6: Jenna (age 50)files single and reports AGI

Q7: Frieda is 67 years old and deaf.If

Q8: Homer is an executive who is paid

Q31: Taxpayers generally deduct the lesser of their

Q47: Cesare is 16 years old and works

Q84: Unreimbursed employee business expenses and hobby expenses