Essay

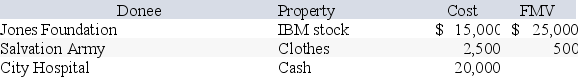

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock has been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock has been owned for 10 years.

Correct Answer:

Verified

The charitable deduction is $40,500 over...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Rachel is an engineer who practices as

Q19: Toshiomi works as a sales representative and

Q21: Which of the following is a true

Q24: Opal fell on the ice and injured

Q29: Which of the following is a true

Q32: Which of the following is a true

Q51: Generally, service businesses are considered qualified trade

Q52: In general, taxpayers are allowed to deduct

Q65: Bunching itemized deductions is one form of

Q85: Margaret Lindley paid $15,000 of interest on