Essay

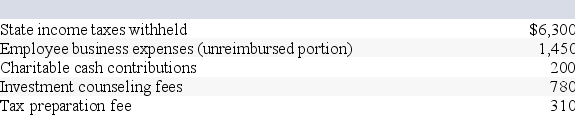

Toshiomi works as a sales representative and travels extensively for his employer's business.This year Toshiomi was paid $75,000 in salary and made the following expenditures:

Toshiomi also made a number of trips to Las Vegas for gambling.This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420).Calculate Toshiomi's 2019 taxable income if he files single.

Toshiomi also made a number of trips to Las Vegas for gambling.This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420).Calculate Toshiomi's 2019 taxable income if he files single.

Correct Answer:

Verified

$68,500.

$68,500 = ($75,000 salary + $12...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$68,500 = ($75,000 salary + $12...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: The deduction to individual taxpayers for charitable

Q15: Which of the following taxes will not

Q18: Rachel is an engineer who practices as

Q21: Which of the following is a true

Q22: This year Latrell made the following charitable

Q24: Opal fell on the ice and injured

Q29: Which of the following is a true

Q51: Generally, service businesses are considered qualified trade

Q83: Claire donated 200 publicly traded shares of

Q85: Margaret Lindley paid $15,000 of interest on