Multiple Choice

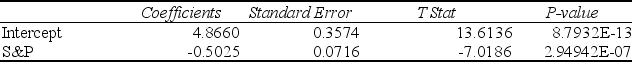

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

-Referring to Table 13-7, which of the following will be a correct conclusion?

A) We cannot reject the null hypothesis and, therefore, conclude that there is sufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

B) We can reject the null hypothesis and, therefore, conclude that there is sufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

C) We cannot reject the null hypothesis and, therefore, conclude that there is not sufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

D) We can reject the null hypothesis and conclude that there is not sufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: TABLE 13-4<br>The managers of a brokerage firm

Q22: Testing for the existence of correlation is

Q33: TABLE 13-4<br> The managers of

Q109: TABLE 13-3<br>The director of cooperative education at

Q119: TABLE 13-12<br>The manager of the purchasing department

Q141: TABLE 13-11<br>A computer software developer would like

Q157: The strength of the linear relationship between

Q180: TABLE 13-10<br>The management of a chain electronic

Q195: You give a pre-employment examination to your

Q208: TABLE 13-7<br>An investment specialist claims that if