Essay

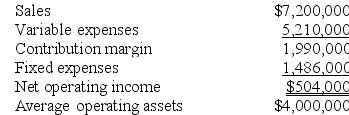

Wolley Inc. reported the following results from last year's operations:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year, would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

Correct Answer:

Verified

1. Last year's Margin = Net operating in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: A manager would generally like to see

Q36: Babak Industries is a division of a

Q49: Anguiano Inc. reported the following results

Q51: Othman Inc. has a $800,000 investment

Q53: Dacker Products is a division of

Q56: Schapp Corporation keeps careful track of

Q57: Robichau Inc. reported the following results from

Q85: The use of return on investment (ROI)

Q105: Which of the following will not result

Q106: Financial measures such as ROI and residual