Multiple Choice

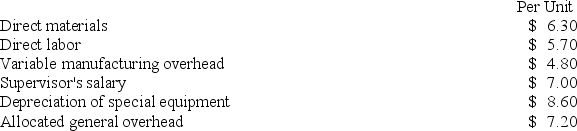

Part S51 is used in one of Haberkorn Corporation's products. The company makes 12,000 units of this part each year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce this part and sell it to the company for $37.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $17,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to produce this part and sell it to the company for $37.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $17,000 of these allocated general overhead costs would be avoided.

The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

A) ($5,800)

B) ($22,800)

C) ($149,800)

D) ($39,800)

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Kinsi Corporation manufactures five different products. All

Q64: Variable costs are always relevant costs in

Q70: Consistency demands that a cost that is

Q115: Cranston Corporation makes four products in a

Q117: Anglen Co. manufactures and sells trophies

Q119: The Jabba Corporation manufactures the "Snack Buster"

Q121: Ibsen Company makes two products from a

Q122: The constraint at Pickrel Corporation is time

Q214: A study has been conducted to determine

Q350: Companies often allocate common fixed costs among