Essay

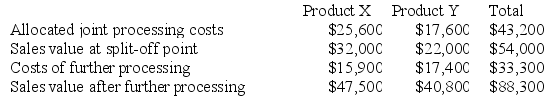

Ibsen Company makes two products from a common input. Joint processing costs up to the split-off point total $43,200 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

Required:

Required:

a. What is financial advantage (disadvantage) of processing Product X beyond the split-off point?

b. What is financial advantage (disadvantage) of processing Product Y beyond the split-off point?

c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Kinsi Corporation manufactures five different products. All

Q64: Variable costs are always relevant costs in

Q70: Consistency demands that a cost that is

Q88: The opportunity cost of making a component

Q117: Anglen Co. manufactures and sells trophies

Q119: The Jabba Corporation manufactures the "Snack Buster"

Q120: Part S51 is used in one of

Q122: The constraint at Pickrel Corporation is time

Q214: A study has been conducted to determine

Q350: Companies often allocate common fixed costs among