Multiple Choice

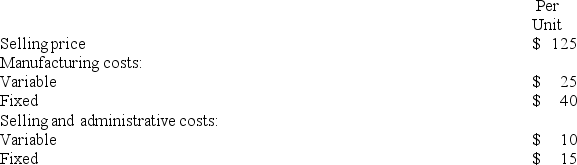

CoolAir Corporation manufactures portable window air conditioners. CoolAir has the capacity to manufacture and sell 80,000 air conditioners each year but is currently only manufacturing and selling 60,000. The following per unit numbers relate to annual operations at 60,000 units:  The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each. Variable selling and administrative costs on this special order will drop down to $2 per unit. This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs. The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be:

The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each. Variable selling and administrative costs on this special order will drop down to $2 per unit. This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs. The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be:

A) ($21,000)

B) $24,000

C) $144,000

D) ($129,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q143: Ahrends Corporation makes 70,000 units per year

Q144: Mcfarlain Corporation is presently making part U98

Q145: Which of the following would be relevant

Q147: Bruce Corporation makes four products in a

Q149: The management of Furrow Corporation is considering

Q150: Danny Dolittle makes crafts in his spare

Q151: The Draper Corporation is considering dropping its

Q152: The most recent monthly income statement for

Q153: Ouzts Corporation is considering Alternative A and

Q297: Priddy Corporation processes sugar cane in batches.