Multiple Choice

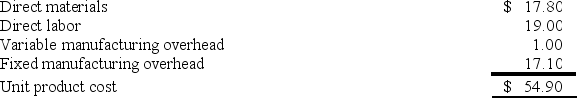

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

What is the financial advantage (disadvantage) of purchasing the part rather than making it? (Round your intermediate calculations to 2 decimal places.)

A) $273,000

B) ($126,000)

C) $147,000

D) $448,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: In a special order situation, any fixed

Q9: A product whose revenues do not cover

Q138: Drew Cane Products, Inc., processes sugar cane

Q138: Two or more products that are produced

Q144: Mcfarlain Corporation is presently making part U98

Q145: Which of the following would be relevant

Q147: Bruce Corporation makes four products in a

Q148: CoolAir Corporation manufactures portable window air conditioners.

Q297: Priddy Corporation processes sugar cane in batches.

Q358: Eliminating nonproductive processing time is particularly important