Multiple Choice

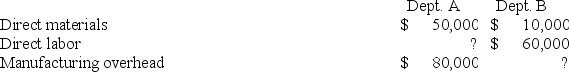

Grib Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs. The predetermined overhead rates for the year are 200% of direct labor cost for Department A and 50% of direct labor cost for Department B. Job 436, started and completed during the year, was charged with the following costs:  The total manufacturing cost assigned to Job 436 was:

The total manufacturing cost assigned to Job 436 was:

A) $360,000

B) $390,000

C) $270,000

D) $480,000

Correct Answer:

Verified

Correct Answer:

Verified

Q94: Huang Aerospace Corporation manufactures aviation control panels

Q95: Halbur Corporation has two manufacturing departments--Machining and

Q96: Opunui Corporation has two manufacturing departments--Molding and

Q97: Sivret Corporation uses a job-order costing system

Q98: Sivret Corporation uses a job-order costing system

Q100: Collini Corporation has two production departments, Machining

Q101: Dehner Corporation uses a job-order costing system

Q102: Mundorf Corporation has two manufacturing departments--Forming and

Q103: Stoke Corporation has two production departments, Forming

Q104: Beans Corporation uses a job-order costing system