Multiple Choice

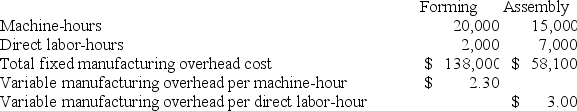

Stoke Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A460. The following data were recorded for this job:

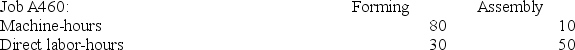

During the current month the company started and finished Job A460. The following data were recorded for this job: The amount of overhead applied in the Forming Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Forming Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $184,000.00

B) $184.00

C) $736.00

D) $664.00

Correct Answer:

Verified

Correct Answer:

Verified

Q98: Sivret Corporation uses a job-order costing system

Q99: Grib Corporation uses a predetermined overhead rate

Q100: Collini Corporation has two production departments, Machining

Q101: Dehner Corporation uses a job-order costing system

Q102: Mundorf Corporation has two manufacturing departments--Forming and

Q104: Beans Corporation uses a job-order costing system

Q107: Nielsen Corporation has two manufacturing departments--Machining and

Q108: Giannitti Corporation bases its predetermined overhead rate

Q275: Generally speaking, when going through the process

Q340: Kreuzer Corporation is using a predetermined overhead