Multiple Choice

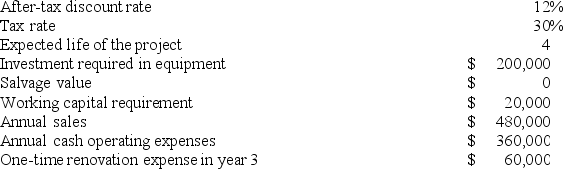

Antinoro Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment.

The company uses straight-line depreciation on all equipment.

The income tax expense in year 2 is:

A) $3,000

B) $18,000

C) $36,000

D) $21,000

Correct Answer:

Verified

Correct Answer:

Verified

Q122: Boynes Corporation is considering a capital budgeting

Q123: Planas Corporation has provided the following information

Q124: Skowyra Corporation has provided the following information

Q125: Condo Corporation has provided the following information

Q128: Petro Corporation has provided the following information

Q129: Marasco Corporation has provided the following information

Q130: Houze Corporation has provided the following information

Q131: Mesko Corporation has provided the following information

Q169: Correll Corporation is considering a capital budgeting

Q275: A capital budgeting project's incremental net income