Multiple Choice

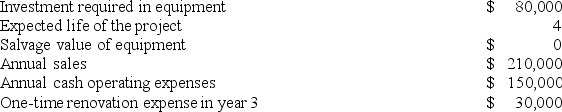

Planas Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

A) $12,000

B) $18,000

C) $3,000

D) $9,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Bedolla Corporation is considering a capital budgeting

Q119: Correll Corporation is considering a capital budgeting

Q121: Patenaude Corporation has provided the following information

Q122: Boynes Corporation is considering a capital budgeting

Q124: Skowyra Corporation has provided the following information

Q125: Condo Corporation has provided the following information

Q127: Antinoro Corporation has provided the following information

Q128: Petro Corporation has provided the following information

Q169: Correll Corporation is considering a capital budgeting

Q332: Last year the sales at Summit Corporation