Essay

Cabigas Corporation manufactures two products, Product C and Product D. The company estimated it would incur $167,140 in manufacturing overhead costs during the current period. Overhead currently is applied to the products on the basis of direct labor-hours. Data concerning the current period's operations appear below:

Required:

a. Compute the predetermined overhead rate under the current method, and determine the unit product cost of each product for the current year.

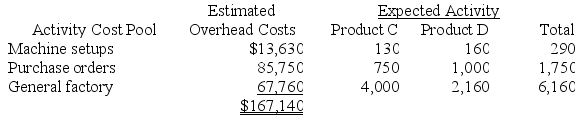

b. The company is considering using an activity-based costing system to compute unit product costs for external financial reports instead of its traditional system based on direct labor-hours. The activity-based costing system would use three activity cost pools. Data relating to these activities for the current period are given below:

Determine the unit product cost of each product for the current period using the activity-based costing approach. General factory overhead is allocated based on direct labor-hours.

Determine the unit product cost of each product for the current period using the activity-based costing approach. General factory overhead is allocated based on direct labor-hours.

Correct Answer:

Verified

a. The expected total direct labor-hours...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Coudriet Manufacturing Corporation has a traditional costing

Q4: Look Manufacturing Corporation has a traditional costing

Q5: Njombe Corporation manufactures a variety of products.

Q6: Njombe Corporation manufactures a variety of products.

Q7: Adelberg Corporation makes two products: Product A

Q9: Werger Manufacturing Corporation has a traditional costing

Q10: Torri Manufacturing Corporation has a traditional costing

Q11: Welk Manufacturing Corporation has a traditional costing

Q12: Adelberg Corporation makes two products: Product A

Q13: Feauto Manufacturing Corporation has a traditional costing