Multiple Choice

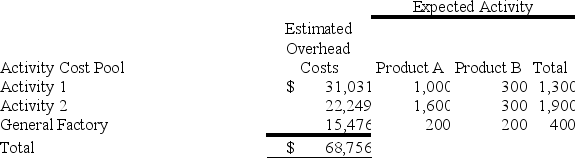

Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756. The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The overhead cost per unit of Product B under the traditional costing system is closest to:

A) $2.34

B) $7.74

C) $4.77

D) $34.38

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Bullie Manufacturing Corporation has a traditional

Q3: Coudriet Manufacturing Corporation has a traditional costing

Q4: Look Manufacturing Corporation has a traditional costing

Q5: Njombe Corporation manufactures a variety of products.

Q6: Njombe Corporation manufactures a variety of products.

Q8: Cabigas Corporation manufactures two products, Product

Q9: Werger Manufacturing Corporation has a traditional costing

Q10: Torri Manufacturing Corporation has a traditional costing

Q11: Welk Manufacturing Corporation has a traditional costing

Q12: Adelberg Corporation makes two products: Product A