Multiple Choice

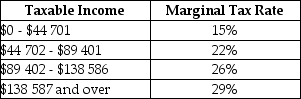

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much total federal tax would be due?

A) $6109

B) $8959

C) $31 200

D) $24 494

E) $28 020

Correct Answer:

Verified

Correct Answer:

Verified

Q50: An income tax is progressive if,as income

Q51: Which of the following statements about the

Q52: The diagram below shows supply and demand

Q53: If there were "horizontal equity" between all

Q54: The table below shows 2015 federal income-tax

Q56: Suppose there is only one movie theatre

Q57: Suppose a firm buys $3000 worth of

Q58: Suppose there is only one movie theatre

Q59: From the perspective of individuals,the goods and

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg" alt=" FIGURE 18-3 -Refer