Multiple Choice

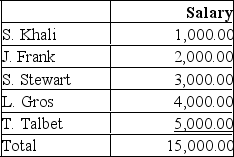

Stellar Company employees had the following earnings records at the close of the April 30 payroll period:  Stellar Company's payroll benefits expense for each employee includes: 4.95% CPP and 1.66% EI on the amount earned. What is the total payroll benefits expense for the November 30 pay period?

Stellar Company's payroll benefits expense for each employee includes: 4.95% CPP and 1.66% EI on the amount earned. What is the total payroll benefits expense for the November 30 pay period?

A) $991.50

B) $742.50

C) $348.60

D) $1,091.10

E) $796.11

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A company's 18 sales personnel earned salaries

Q2: Most employers engaged in employing workers must

Q3: The Payroll Register provides the information needed

Q5: The Employee's Individual Earnings Record serves as

Q6: Payroll taxes are levied on wages actually

Q7: Spieth Company employees had the following earnings

Q8: The entry to record payroll includes a

Q9: Employers never make deductions from employees' wages

Q10: The amount an employee earns before any

Q11: Employee (fringe) benefit costs represent expenses to