Essay

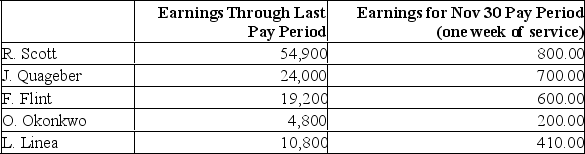

Spieth Company employees had the following earnings records at the close of the November 30 payroll period.

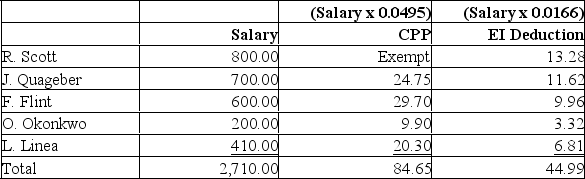

Spieth Company's payroll taxes expense for each employee include: 4.95% CPP on the annual pensionable earnings 50,100 ($55,900 maximum with the first $3,500 exempt), and 1.4 times the employees EI rate of 1.66% paid to a maximum of $51,700 annually. As well, $300 in federal and provincial income taxes will be deducted from the employees' gross pay for the week. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.

Spieth Company's payroll taxes expense for each employee include: 4.95% CPP on the annual pensionable earnings 50,100 ($55,900 maximum with the first $3,500 exempt), and 1.4 times the employees EI rate of 1.66% paid to a maximum of $51,700 annually. As well, $300 in federal and provincial income taxes will be deducted from the employees' gross pay for the week. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.

Note that R. Scott would have already paid the maximum CPP and EI for the year

Note that R. Scott would have already paid the maximum CPP and EI for the year

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Most employers engaged in employing workers must

Q3: The Payroll Register provides the information needed

Q4: Stellar Company employees had the following earnings

Q5: The Employee's Individual Earnings Record serves as

Q6: Payroll taxes are levied on wages actually

Q8: The entry to record payroll includes a

Q9: Employers never make deductions from employees' wages

Q10: The amount an employee earns before any

Q11: Employee (fringe) benefit costs represent expenses to

Q12: Payroll taxes levied on employers include Canada