Multiple Choice

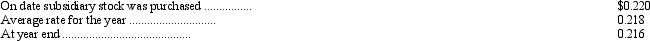

Sarkozy Enterprises, a subsidiary of Obama Company based in New York, reported the following information at the end of its first year of operations (all in French francs) : assets--4,790,000; expenses--6,500,000; liabilities--2,950,000; capital stock--1,200;000, revenues--7,140,000. Relevant exchange rates are as follows:

As a result of the translation process, what amount is recorded on the financial statements as the translation adjustment?

A) $1,287 debit adjustment

B) $1,287 credit adjustment

C) $6,080 debit adjustment

D) $6,080 credit adjustment

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Domingo Company, a U.S. company, owns a

Q5: Northern Metalworks, Inc., purchased Canadian Metal Products,

Q6: Which of the following is true regarding

Q9: Under international accounting standards, the derecognition of

Q10: Rome Enterprises, a subsidiary of La Italia

Q11: Under international accounting standards,cash paid for interest

Q11: The following financial information is for Olaf

Q16: Under international accounting standards,the pension-related asset or

Q42: Which of the following is correct regarding

Q48: Which of the following statements most accurately