Essay

Domingo Company, a U.S. company, owns a 100% interest in its subsidiary, Pavarotti, S.A., located in Italy. Pavarotti, S.A., began operations on January 1, 2011. The subsidiary's operations consist of leasing space in an office building. The building, which cost one million euros, was financed primarily by Italian banks. All revenues and expenses are received and paid in euros. The subsidiary also maintains its accounting records in euros. In light of these facts, management of the U.S. parent has determined that the euro is the functional currency of the subsidiary.

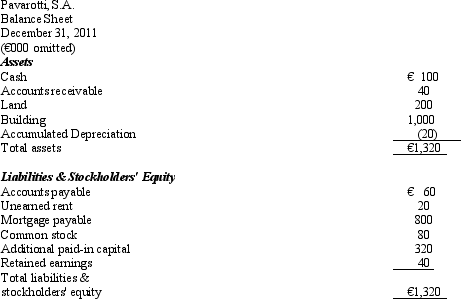

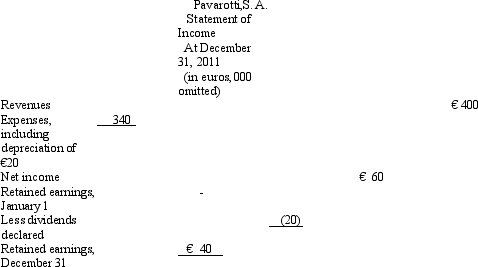

The subsidiary's balance sheet at December 31, 2011, and income statement for the year then ended, are presented below, in euros:

The following are relevant exchange rates for the year 2011:

€1 = $1.50 at the beginning of 2011, at which time the common stock

was issued and the land and building were financed by the mortgage.

€1 = $1.55 weighted average for 2011.

€1 = $1.58 at the date the dividends were declared and paid and

the unearned rent was received.

€1 = $1.62 at the end of 2011.

Required:

Prepare in U.S. dollars a balance sheet at December 31, 2011, and an income statement for the year then ended.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The following financial information is for DC

Q5: Northern Metalworks, Inc., purchased Canadian Metal Products,

Q6: Which of the following is true regarding

Q8: Sarkozy Enterprises, a subsidiary of Obama Company

Q9: Under international accounting standards, the derecognition of

Q10: Rome Enterprises, a subsidiary of La Italia

Q11: Under international accounting standards,cash paid for interest

Q11: The following financial information is for Olaf

Q16: Under international accounting standards,the pension-related asset or

Q29: Current generally accepted accounting principles require that