Multiple Choice

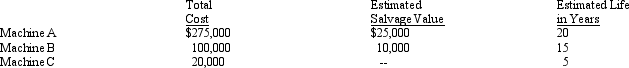

At the start of its business, Snell Corp. decided to use the composite method of depreciation and prepared the following schedule of machinery owned.

Snell computes depreciation on the straight-line method. Based on the information presented, the composite life of these assets (in years) should be

A) 13.3.

B) 16.0.

C) 18.0.

D) 19.8.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: When the estimate of an asset's useful

Q22: Luther Soaps purchased a machine on January

Q23: Which of the following statements is the

Q25: The following is a schedule of machinery

Q26: Hartwell Trucking traded a used truck with

Q28: Depreciation is the systematic allocation of historical

Q29: Which of the following utilizes the straight-line

Q31: In January 2011, Vance Mining Corporation purchased

Q32: Overberg Company purchased a machine on January

Q63: A company using the group depreciation method