Essay

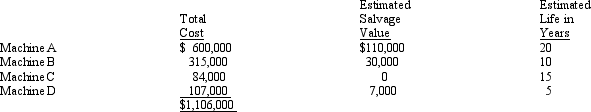

The following is a schedule of machinery owned by Martin Manufacturing Company.

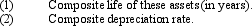

Martin computes depreciation on the straight-line basis. Based on the information presented, compute the:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: When the estimate of an asset's useful

Q6: The sale of a depreciable asset resulting

Q21: Which of the following depreciation methods applies

Q22: Luther Soaps purchased a machine on January

Q23: Which of the following statements is the

Q26: Hartwell Trucking traded a used truck with

Q27: At the start of its business, Snell

Q28: Depreciation is the systematic allocation of historical

Q29: Which of the following utilizes the straight-line

Q63: A company using the group depreciation method