Essay

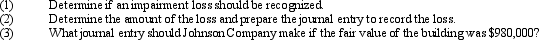

Johnson Company is located in Hong Kong and uses international accounting standards. Johnson Company purchased equipment 8 years ago for $1,000,000. The equipment has been depreciated using the straight-line method with a 20-year useful life and 10% residual value. Johnson's operations have experienced significant losses for the past 2 years and, as a result, the company has decided that the equipment should be evaluated for possible impairment. The management of Johnson Company estimates that the equipment has a remaining useful life of 7 years. The discounted value of the future net cash inflows from the use of the equipment is $220,000. The fair value of the equipment is $240,000. No goodwill was associated with the purchase of the equipment. Johnson Company has chosen to recognize increases in the value of long-term operating assets in accordance with the allowable alternative under IAS 36.

Correct Answer:

Verified

(1)Annual depreciation for the equipment...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: When assets are exchanged at a loss

Q54: On January 1, 2010, Herschel Locks Corporation

Q56: In January 2011, Bevis Company exchanged an

Q57: When an exchange of similar assets involves

Q58: On January 1, 2011, Carson Company purchased

Q60: Five years ago, Goodman, Inc., purchased a

Q61: Wilbur Company acquired Smith Company on January

Q61: A company owns a piece of land

Q63: Use-factor depreciation methods view asset consumption as

Q64: Johnson Company purchased equipment 8 years ago