Essay

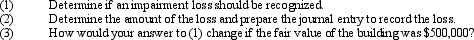

Johnson Company purchased equipment 8 years ago for $1,000,000. The equipment has been depreciated using the straight-line method with a 20-year useful life and 10% residual value. Johnson's operations have experienced significant losses for the past 2 years and, as a result, the company has decided that the equipment should be evaluated for possible impairment. The management of Johnson Company estimates that the equipment has a remaining useful life of 7 years. Net cash inflow from the equipment will be $80,000 per year. The fair value of the equipment is $240,000.

Correct Answer:

Verified

(1)Annual depreciation for the equipment...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Which of the following depreciation methods is

Q59: Johnson Company is located in Hong Kong

Q60: Five years ago, Goodman, Inc., purchased a

Q61: A company owns a piece of land

Q61: Wilbur Company acquired Smith Company on January

Q63: Use-factor depreciation methods view asset consumption as

Q65: Riley Company owns a machine that cost

Q68: Information needed to compute a depletion charge

Q68: Joseph Company acquired a tract of land

Q69: On July 1, Phoenix Corporation, a calendar-year