Multiple Choice

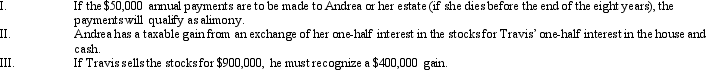

Travis and Andrea were divorced.Their only marital property consisted of a personal residence (fair market value of $400,000,cost of $200,000) ,and publicly-traded stocks (fair market value of $800,000,cost basis of $500,000) .Under the terms of the divorce agreement,Andrea received the personal residence and Travis received the stocks.In addition,Andrea was to receive $50,000 for eight years.

A) Only III is true.

B) Only I and III are true.

C) Only I and II are true.

D) I,II,and III are true.

E) None of the above are true.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Jena is a full-time undergraduate student at

Q26: Mr. Lee is a citizen and resident

Q34: The maximum child tax credit under current

Q43: The filing status of a taxpayer (e.g.,

Q63: Derek,age 46,is a surviving spouse.If he has

Q64: In 2013,Boris pays a $3,800 premium for

Q65: Tony,age 15,is claimed as a dependent by

Q67: Georgia had AGI of $100,000 in 2013.She

Q92: Jack received a court award in a

Q108: In determining the filing requirement based on