Essay

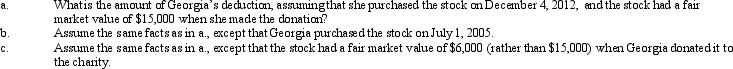

Georgia had AGI of $100,000 in 2013.She donated Heron Corporation stock with a basis of $8,500 to a qualified charitable organization on July 5,2013.

Correct Answer:

Verified

General discussion.The deduction for a c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

General discussion.The deduction for a c...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q19: Jena is a full-time undergraduate student at

Q34: The maximum child tax credit under current

Q43: The filing status of a taxpayer (e.g.,

Q45: Interest paid or accrued during the tax

Q63: Derek,age 46,is a surviving spouse.If he has

Q64: In 2013,Boris pays a $3,800 premium for

Q65: Tony,age 15,is claimed as a dependent by

Q68: Travis and Andrea were divorced.Their only marital

Q92: Jack received a court award in a

Q108: In determining the filing requirement based on