Multiple Choice

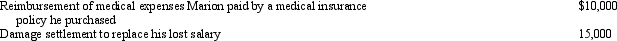

Early in the year,Marion was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained,he received the following payments during the year:  What is the amount that Marion must include in gross income for the current year?

What is the amount that Marion must include in gross income for the current year?

A) $25,000.

B) $15,000.

C) $12,500.

D) $10,000.

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Rick and Carol Ryan, married taxpayers, took

Q14: For dependents who have income, special filing

Q24: In terms of the tax formula applicable

Q59: An above-the-line deduction refers to a deduction

Q67: Tim and Janet were divorced.Their only marital

Q89: Excess charitable contributions that come under the

Q89: Under the Federal income tax formula for

Q132: Ashley earns a salary of $55,000,has capital

Q139: Barbara was injured in an automobile accident.She

Q141: Linda,who has AGI of $120,000 in 2013,contributes