Essay

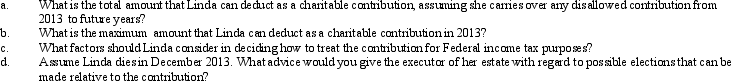

Linda,who has AGI of $120,000 in 2013,contributes stock in Mauve Corporation (a publicly traded corporation)to the Salvation Army,a qualified charitable organization.The stock is worth $65,000,and Linda acquired it as an investment four years ago at a cost of $50,000.

Correct Answer:

Verified

General discussion.The stock is apprecia...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Rick and Carol Ryan, married taxpayers, took

Q24: In terms of the tax formula applicable

Q89: Under the Federal income tax formula for

Q89: Excess charitable contributions that come under the

Q106: Which, if any, of the statements regarding

Q137: Early in the year,Marion was in an

Q139: Barbara was injured in an automobile accident.She

Q143: Wilma,age 70 and single,is claimed as a

Q144: In 2013,Khalid was in an automobile accident

Q145: In 2006,Ross,who is single,purchased a personal residence