Multiple Choice

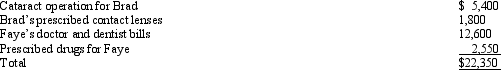

Brad,who would otherwise qualify as Faye's dependent,had gross income of $9,000 during the year.Faye,who had AGI of $120,000,paid the following medical expenses in 2013:  Assuming Faye is age 45,she has a medical expense deduction of:

Assuming Faye is age 45,she has a medical expense deduction of:

A) $3,150.

B) $4,950.

C) $10,350.

D) $13,350.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: After Ellie moves out of the apartment

Q6: An individual generally may claim a credit

Q8: As an executive of Cherry, Inc., Ollie

Q16: In terms of the tax formula applicable

Q52: Thelma and Mitch were divorced.The couple had

Q56: Sergio was required by the city to

Q63: Since an abandoned spouse is treated as

Q73: Olaf was injured in an automobile accident

Q115: Pedro is married to Consuela, who lives

Q172: During 2013,Hugh,a self-employed individual,paid the following amounts: