Multiple Choice

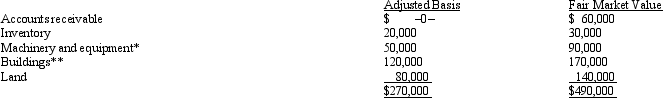

Mr.and Ms.Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Normally a C corporation shareholder would prefer

Q14: Do the § 465 at-risk rules treat

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q32: Barb and Chuck each own one-half of

Q48: Albert's sole proprietorship owns the following assets:

Q53: The AMT statutory rate for C corporations

Q62: List some techniques for reducing and/or avoiding

Q65: How can double taxation be avoided or

Q85: If lease rental payments to a noncorporate

Q162: Factors that should be considered in making