Multiple Choice

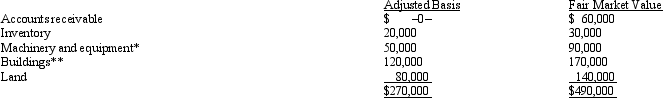

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Do the § 465 at-risk rules treat

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q32: Barb and Chuck each own one-half of

Q45: Mr.and Ms.Smith's partnership owns the following assets:

Q51: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's

Q53: The AMT statutory rate for C corporations

Q53: A C corporation offers greater flexibility in

Q85: If lease rental payments to a noncorporate

Q133: Melba contributes land (basis of $190,000; fair

Q162: Factors that should be considered in making