Essay

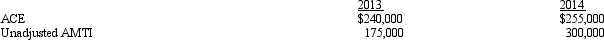

Duck,Inc.,is a C corporation that is not eligible for the small business exception to the AMT.Its adjusted current earnings (ACE)and unadjusted alternative minimum taxable income (unadjusted AMTI)for 2013 and 2014 are as follows:

Calculate the amount of the ACE adjustment for 2013 and 2014.

Calculate the amount of the ACE adjustment for 2013 and 2014.

Correct Answer:

Verified

For 2013,there is a positive ACE adjustm...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Arnold purchases a building for $750,000 which

Q3: A limited partnership can indirectly avoid unlimited

Q8: Section 1244 ordinary loss treatment is available

Q11: An S corporation election for Federal income

Q33: Actual dividends paid to shareholders result in

Q40: If an S corporation distributes appreciated property

Q65: List some techniques which can be used

Q85: If an individual contributes an appreciated personal

Q106: Anne contributes property to the TCA Partnership

Q114: Which of the following statements is correct?<br>A)