Essay

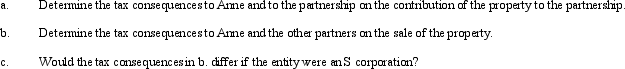

Anne contributes property to the TCA Partnership which was formed 8 years ago by Clark and Tara.Anne's basis for the property is $90,000 and the fair market value is $220,000.Anne receives a 25% interest for her contribution.Because the TCA Partnership is unsuccessful in having the property rezoned from agricultural to commercial,it sells the property 14 months later for $225,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Arnold purchases a building for $750,000 which

Q8: Section 1244 ordinary loss treatment is available

Q11: An S corporation election for Federal income

Q33: Actual dividends paid to shareholders result in

Q40: If an S corporation distributes appreciated property

Q65: List some techniques which can be used

Q85: If an individual contributes an appreciated personal

Q105: Duck,Inc.,is a C corporation that is not

Q114: Which of the following statements is correct?<br>A)

Q134: Trolette contributes property with an adjusted basis