Essay

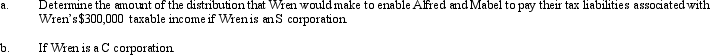

Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 35%.Wren's taxable income for 2013 is $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Do the § 465 at-risk rules treat

Q20: The § 465 at-risk provision and the

Q31: Tonya contributes $150,000 to Swan, Inc., for

Q32: Barb and Chuck each own one-half of

Q48: Albert's sole proprietorship owns the following assets:

Q50: Melinda's basis for her partnership interest is

Q53: A C corporation offers greater flexibility in

Q107: The special allocation opportunities that are available

Q133: Melba contributes land (basis of $190,000; fair

Q162: Factors that should be considered in making