Essay

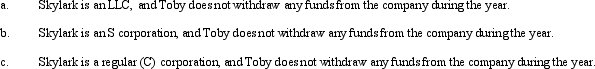

During the current year,Skylark Company had operating income of $420,000 and operating expenses of $250,000.In addition,Skylark had a long-term capital loss of $20,000,and a charitable contribution of $5,000.How does Toby,the sole owner of Skylark Company,report this information on his individual income tax return under following assumptions?

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Double taxation of corporate income results because

Q22: Which, if any, of the following transactions

Q24: The tax law allows,under certain conditions,deferral of

Q25: Amber Company has $100,000 in net income

Q31: State and local governments are sometimes forced

Q103: A taxpayer is considering the formation of

Q113: Unlike FICA, FUTA requires that employers comply

Q139: Which, if any, of the following provisions

Q164: Under the usual state inheritance tax, two

Q171: An inheritance tax is a tax on