Essay

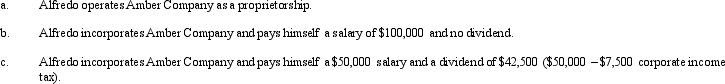

Amber Company has $100,000 in net income in 2013 before deducting any compensation or other payment to its sole owner,Alfredo.Assume that Alfredo is in the 33% marginal tax bracket.Discuss the tax aspects of each of the following independent arrangements.(Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Correct Answer:

Verified

c.

c. Amber's tax on $ 50,000 a...

Amber's tax on $ 50,000 a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Double taxation of corporate income results because

Q22: Which, if any, of the following transactions

Q24: The tax law allows,under certain conditions,deferral of

Q26: During the current year,Skylark Company had operating

Q83: Currently, the tax base for the Social

Q103: A taxpayer is considering the formation of

Q113: Unlike FICA, FUTA requires that employers comply

Q139: Which, if any, of the following provisions

Q164: Under the usual state inheritance tax, two

Q171: An inheritance tax is a tax on