Multiple Choice

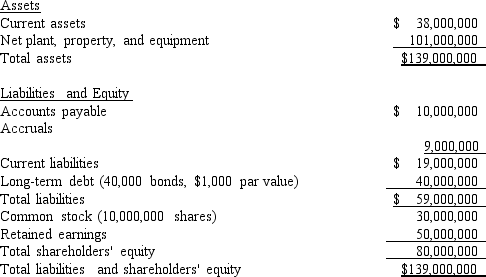

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the after-tax cost of debt?

A) 4.64%

B) 4.88%

C) 5.14%

D) 5.40%

E) 5.67%

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following statements is CORRECT?<br>A)

Q13: Which of the following is NOT a

Q19: Which of the following statements is CORRECT?<br>A)

Q41: When estimating the cost of equity by

Q50: The lower the firm's tax rate, the

Q60: For capital budgeting and cost of capital

Q69: Trahern Baking Co.common stock sells for $32.50

Q73: Firms raise capital at the total corporate

Q89: To help them estimate the company's cost

Q90: The text identifies three methods for estimating