Short Answer

Consider the following set of quarterly sales data, given in thousands of dollars.

The following dummy variable model that incorporates a linear trend and constant seasonal variation was used: y(t) = β0 + β1t + βQ1(Q1) + βQ2(Q2) + βQ3(Q3) + Et. In this model, there are three binary seasonal variables (Q1, Q2, and Q3), where Qi is a binary (0,1) variable defined as:

The following dummy variable model that incorporates a linear trend and constant seasonal variation was used: y(t) = β0 + β1t + βQ1(Q1) + βQ2(Q2) + βQ3(Q3) + Et. In this model, there are three binary seasonal variables (Q1, Q2, and Q3), where Qi is a binary (0,1) variable defined as:

Qi = 1, if the time series data is associated with quarter i;

Qi = 0, if the time series data is not associated with quarter i.

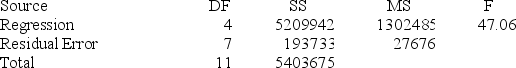

The results associated with this data and model are given in the following Minitab computer output.

The regression equation is

Sales = 2442 + 6.2 Time − 693 Q1 − 1499 Q2 + 153 Q3

Analysis of Variance

Analysis of Variance

Provide a managerial interpretation of the regression coefficient for the variable "time."

Provide a managerial interpretation of the regression coefficient for the variable "time."

Correct Answer:

Verified

It is estimated that...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: When preparing a price index based on

Q128: Consider the quarterly production data (in thousands

Q129: Simple exponential smoothing is a forecasting method

Q130: A forecasting method that weights recent observations

Q131: When there is _ seasonal variation, the

Q133: The Box-Jenkins methodology can be used to

Q134: XYZ Company, Annual Data <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7056/.jpg" alt="XYZ

Q135: A positive autocorrelation implies that negative error

Q136: The multiplicative Winters method is used to

Q137: The following data on prices and quantities