Multiple Choice

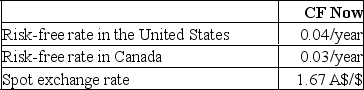

Consider the following:  If the futures market price is 1.63 A$/$, how could you arbitrage?

If the futures market price is 1.63 A$/$, how could you arbitrage?

A) Borrow Australian dollars in Canada convert them to dollars, lend the proceeds in the United States, and enter futures positions to purchase Canadian dollars at the current futures price.

B) Borrow U.S.dollars in the United States, convert them to Canadian dollars, lend the proceeds in Canada, and enter futures positions to sell Australian dollars at the current futures price.

C) Borrow U.S.dollars in the United States, invest them in the U.S., and enter futures positions to purchase Canadian dollars at the current futures price.

D) Borrow Canadian dollars in Canada and invest them there, then convert back to U.S.dollars at the spot price.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Suppose that the risk-free rates in the

Q16: If you purchased one S&P 500 Index

Q18: Which one of the following stock index

Q19: In the equation Profits = a +

Q20: If covered interest arbitrage opportunities exist,<br>A)interest rate

Q22: If you took a short position in

Q23: Which one of the following stock index

Q25: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q26: You are given the following information about

Q38: One reason swaps are desirable is that<br>A)