Multiple Choice

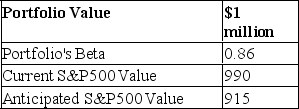

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  For a 75-point drop in the S&P 500, by how much does the futures position change?

For a 75-point drop in the S&P 500, by how much does the futures position change?

A) $200,000

B) $50,000

C) $250,000

D) $500,000

E) $18,750

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Suppose that the risk-free rates in the

Q21: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q22: If you took a short position in

Q23: Which one of the following stock index

Q25: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q27: Foreign exchange futures markets are _, and

Q28: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q30: Credit risk in the swap market<br>A)is extensive.<br>B)is

Q31: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q32: The value of a futures contract for